Annual Leave Carryover

Most employees serving in a foreign area may accumulate up to forty-five days (360 hours) of annual leave. Upon returning to CONUS, the forty-five days maximum annual leave may be retained until the employee's leave balance falls below 45 days (360 hours) at end of the leave year. Some employees, generally “local hires”, may not be eligible for 360 hours carryover (versus 240 hours). Consult HRO if you are recruited from overseas or new to federal employment. (5 U.S.C. 6304(b) applies)

Returning from an overseas post - When you return from an overseas post you are allowed to carry a maximum of 360 hours of annual leave into a new leave year. At the end of that year, if your leave balance is less than 360 hours, then that lower balance becomes your new maximum carry-over amount. As each year goes by, any lower balance at the end of the leave year than what you started with at the beginning of the leave year becomes your maximum carry-over amount, until you reach 240 hours.

PCS/Relocation Frequently Asked Questions

http://www.defensetravel.dod.mil/site/faqpcs.cfm

Home Leave

Employees serving in foreign areas receive five (5) calendar days of home leave for each 12-month period overseas. Employees may take home leave after completion of 24 months of continuous creditable service. Previous accumulated home leave may be used at any time during subsequent overseas tours, subject to certain restrictions during the last months of the current tour. Home leave is typically used in conjunction with Renewal Agreement Travel (RAT), at which time an employee, who has been offered and has accepted an invitation to extend his/her overseas tour, elects to take his/her RAT entitlement. (From Overseas Allowances Benefits 18 Aug 15)

Purpose

Home leave is a period of approved absence with pay authorized by 5 U.S.C. 6305 for employees stationed abroad. Home leave is for use in the United States, or if the employee's place of residence is outside the area of employment, in the Commonwealth of Puerto Rico or the territories or possessions of the United States.

Eligibility for Home Leave

Employees serving outside the United States who meet the requirements of 5 U.S.C. 6304(b) for the accumulation of a maximum of 45 days (360 hours) of annual leave are eligible for home leave benefits. “Local Hires” are not eligible for Home Leave.

Accrual of Home Leave

Service abroad means service by an employee at a post of duty outside the United States and outside the employee's place of residence if his or her place of residence is in the Commonwealth of Puerto Rico or a territory or possession of the United States.

No home leave will be accrued for an employee who would normally meet the requirements for the accrual of home leave, when the period of service abroad is interrupted by a tour of duty in the United States Armed Forces. However, the time spent in the Armed Forces will be counted towards "continuous creditable service."

Environmental Morale Leave (EML) Program

The Environmental Morale Leave (EML) Program is offered to all active duty military personnel, all DOD civilians with travel agreements and their sponsored dependents. Authorized EML destinations are designated by appropriate authority and subject to change. Only Unfunded EML (UEML) is available in Japan. UEML is similar to Space “A” Travel but has a higher priority. EML orders are good for 90 days from the date EML orders are issued.

Unfunded EML: This benefit allows travelers to travel in a priority space available status aboard military aircraft or commercially contracted missions to a designated authorized EML destination.

EML Categories of Travel

CAT II - EML (Environmental Morale Leave):

- Sponsors on environmental and morale leave (EML) and accompanied family members (Military personnel must be on ordinary leave, DoD Dependent School (DoDDS) teachers and their accompanied family members are in EML status during school year holiday or vacation periods).

Category IV - Unaccompanied dependents on EML:

- Unaccompanied family members (18 years or older) traveling on EML orders. Family members under 18 must be accompanied by an adult family member who is traveling EML (DoDDS teachers or family members (accompanied or unaccompanied) in an EML status year round).

Fast Facts about EML:

- Sponsors and their accompanied dependents travel in category II.

- Unaccompanied dependents travel in category IV.

- Dependents must be at least 18 years old to travel unaccompanied.

- Only one (1) EML location is authorized per trip. First designated/authorized EML destination reached EML travel stops.

- EML passengers may remain on the Space “A” register for 60 days or until leave expires, whichever occurs first.

- DOD civilian employees must be in a non-duty status to register and remain in this status for as long as they are signed up.

- Your unit will publish EML orders using applicable directives. Only two (2) EML trips a year.

EML Request form and instructions

If an invitation for a 24-month tour extension is extended by the Command and accepted by the employee, the employee and authorized dependents is authorized a round-trip to home of record. Approximately one year prior to the end of the initial 36-month tour of duty, SRF-JRMC will decide whether to offer the employee an extension. If an additional 24 months is offered and the employee accepts, he/she is eligible for Renewal Agreement Travel (RAT). The employee's command pays for this round-trip travel for employees and any authorized dependents. The sponsor is authorized per diem while in a travel status, but dependents are not.

Please see Defense Finance and Accounting Service RAT for more information

https://www.dfas.mil/civilianemployees/civrelo/renewalagreement.html

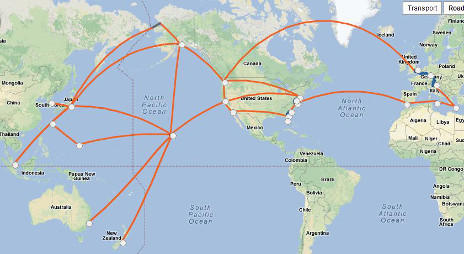

Space A System Map: Space-A travel is a means by which members of United States Uniformed Services (United States Military, reservists and retirees, United States Department of Defense civilian personnel (under certain circumstances), and these groups' family members, are permitted to travel on aircraft under the jurisdiction of the United States Department of Defense when excess capability allows.

The Department of State Standardized Regulations (DSSR) governs allowances and benefits available to U.S. Government civilians assigned to foreign areas. Note that because individual agencies may draft their own implementing regulations, which can be more restrictive than the DSSR, you may not be eligible for all of the allowances listed below. Employees should check both the DSSR and their agency’s implementing regulations for guidance on a specific allowance. Employees of Defense Agencies should refer to Joint Travel Regulations (JTR Vol II Civilians), Chapter 5 (C5010) at http://www.defensetravel.dod.mil/site/travelreg.cfm and DoD 1400.25-M, Civilian Personnel Manual, Subchapter 1250 at https://www.esd.whs.mil/Portals/54/Documents/DD/issuances/140025/1400.25-V1250.pdf.

Federal Income Tax, Social Security, Medicare, State Income & Other Taxes

Each state’s tax laws vary. Please consult your state tax authority or a professional tax advisor.

If you are a U. S. citizen working for the US Government, and you are stationed abroad, your income tax filing requirements are generally the same as those for citizens and residents living in the United States. You are taxed on your worldwide income (“pay”), even though you live and work abroad. However, you may receive certain allowances and have certain expenses that you generally do not have while living in the United States, which might not be taxed.

As you may recall the new tax law signed by the President in December 2017, now makes most of the expenses paid by the Federal Government on behalf of the employee taxable.

The IRS has ruled that any civilian relocation expenses claimed after 1 Jan 2018, but incurred in 2017 will not be taxed. This is a significant update that has been pending since the tax law changed.

Please note that DFAS is still working on updating its travel processing software/system to withhold the new taxes incurred in 2018. Since DFAS is obligated by law to withhold the taxes by end of the year, DFAS expects the system to start withholding the new relocation taxes in December. DFAS advised that W2s received in January 2019 will include all taxable relocation expenses incurred in 2018. Employees may file for RITA in February 2019 or once W2s are received and use RITA reimbursement to pay off the additional debt incurred from the withholding of new relocation taxes or work with DFAS on a payment plan.

As a reminder, employees who wish to find out more information are strongly encouraged to seek professional assistance from a tax advisor. Additionally, more information is available on the DFAS website at:https://www.dfas.mil/civilianemployees/civrelo.html

***SRF-JRMC and PSNS Det do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors for any tax, legal or accounting advice.